October 2023 Edition

These monthly market commentaries share a synopsis of the U.S. financial markets with intelligent insights.

October Investment and Economic Commentary

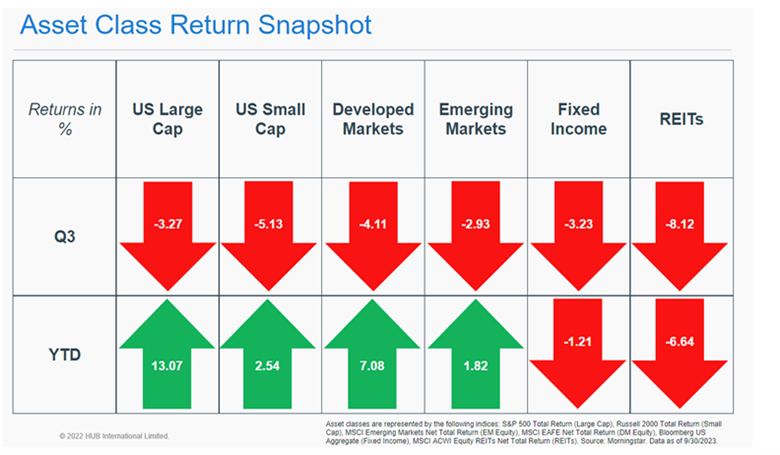

Welcome to the 4th quarter. On the Investment Market Performance Recap report there are a lot of red numbers in the monthly column and almost as many in the Q3 column as well. After the strong first half of 2023, many expected the markets to cool off as growth was to slow and the Fed would need to be less aggressive. The economy has not slowed and the Fed has stuck to its guns in its fight against inflation. One of the most significant factors impacting domestic and foreign equities and bond markets was the steady rise in US interest rates. In Q3, the 10Yr US Treasury yield rose 78bps. This increase in rates weighed on equity valuations, bond returns, and strengthened the US dollar, hurting overseas stocks. As shown in this graphic, Q3 was a challenging environment across all sectors and the positive gains in the first half have turned negative in select asset classes.

Here are a few highlights from what occurred across the public markets during the month and quarter.

Overall

Domestic Equity

International and Global Equities

Fixed Income Markets

Specialty Markets

US Equity Sectors

October 10, 2023

Dear Valued Investor,

The S&P 500 lost 3.3% in the third quarter after sliding nearly 5% in September. Putting this into perspective, nothing really qualifies as out of the ordinary. Since 1950, the S&P 500 has historically declined in September 55% of the time, posting an average decline of 3.8%. September has certainly lived up to its reputation as being a weak seasonal period for stocks. The main culprits were rising interest rates and government shutdown fears.

Whether your goal is growth, value, or probably some combination of the two, there wasn’t a difference in performance between the two (on the Russell 1000 indexes). Stocks in both investing styles generated nearly identical total returns during the quarter. Growth, however, still maintains its more than 11 percentage point year-to-date gain over value.

Energy was by far and away the top performing sector last quarter and the only sector up on the month. The sector has benefited from higher oil prices and increasingly more shareholder-friendly producers. At the other end of the spectrum, real estate and utilities struggled with 9.7% and 10.1% quarterly declines, respectively, as rising interest rates challenged income-oriented sectors. The U.S. slightly outperformed the developed international markets while emerging markets held up slightly better despite the strong U.S. dollar.

Moving onto the economy, we’re feeling the ripple effects as higher short-term interest rates flow into our daily lives— in business and consumer interest rates. For example, would-be homebuyers saw the average 30-year fixed rate reach a 23-year high at the end of last month. Remember, the Federal Reserve (Fed) raised short-term interest rates in an effort to slow the economy and halt inflation, which we are starting to see.

Given the economic backdrop, we wouldn’t be surprised if the markets remain a bit choppy this month. In addition to that, October can be bumpy anyway and of course, the prospect of a government shutdown looms in another six weeks. But overall, we suggest staying the course, and there are plenty of reasons to be cautiously optimistic about where we’re headed:

-The labor market shows signs of moving in the right direction, with more balance between the supply and demand for workers.

-Inflation is coming down. The Fed is most likely done with its aggressive rate-hiking campaign, which is good news for investors and policymakers alike.

-The fourth quarter is historically the best quarter for the S&P 500, with average gains around 4.2%

Underscoring these reasons for staying invested is how difficult it is to time the market, despite some of the risks at hand. Plus, opportunities in high-quality fixed income (e.g. U.S. bonds, corporate bonds) are as attractive as they’ve been in decades. All in all, October can be volatile, but there’s probably no need to get spooked by bouts of higher volatility.

As always, please reach out with any questions.

Securities offered through LPL Financial, Member FINRA & SIPC. Investment advisory services offered through Global Retirement Partners, LLC DBA Connor & Gallagher OneSource, an SEC registered investment advisor. Connor & Gallagher OneSource and Connor & Gallagher Benefit Services are separate entities from LPL Financial.

Tracking # 1-05311403

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All data is provided as of August 3, 2022.

All index data from FactSet.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Wealth Management Services