WHY Work With us?

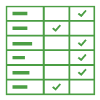

|

We do the work of finding the best rates for you. |

|

Tailored advice |

|

We'll review your policies to ensure your family is well protected with the proper limits. |

|

Only A rated or better insurance carriers considered. |

|

Friendly, experienced, licensed insurance professionals. We strive to provide exceptional customer service not only at the time of purchase but any time you need us. We are here to help with filing a claim, answering your questions - anything we can do to help you our valued client. |

Personal Lines Insurance Products

|

Home |

|

Umbrella |

|

Auto |

|

Boats, Motorcycles, RVs

and more |

Auto and Home Insurance QUotes

If you're ready to see some quotes, click the home & auto insurance image below to provide the information we need and we'll begin shopping for you

CARRIER PARTNERS

SERVING YOU TODAY IS:

Kevin Gardner, Personal Lines Insurance Consultant

Kevin has been a personal lines insurance consultant since 2016. He received his insurance license in June of that year after graduating from Miami University.

"I’ve found that most consumers looking for home and auto insurance all have a common interest in mind: protecting their family with the right coverage for the right price. I have learned to tailor insurance coverage to each family’s specific needs, while also being able to educate and explain as to why these coverages are important for your family." - Kevin

Licensed in property, casualty, life and health insurance.

Kim DeArcangelis, Account Manager/Customer Service, Personal Insurance

Kim has over 10 years of experience working with clients in the insurance industry. She specializes in gold-standard customer service with all her clients, and helps them navigate the insurance waters.

"The most fulfilling and rewarding aspect of my work is the deep, personal connection I form with our clients. It goes beyond business; my clients become like family." - Kim

Katie Grigat, Account Manager

Katie joined CGO in 2024. She graduated from DePaul University in 2022 with a degree in Business and obtained her insurance license in April 2025.

"I love working with client’s personal insurance because every day brings something new—I get to build real relationships with clients, solve problems creatively, and see the direct impact of my work. It’s fast-paced, challenging, and super rewarding." - Katie

Car Insurance Terms to Know

Liability Coverage

- Protects you from financial responsibility for injuries, deaths, or property damage incurred due to your negligence.

- Designed to help protect you financially in the event that you are held liable for injury, death, or property damage suffered by others. This coverage can help pay for expenses related to any legal proceedings that may arise, as well as any damages awarded to the victims.

Property Damage Coverage

- Provides protection for the policyholder against financial losses incurred as the result of damage to someone else's vehicle or property. This can include repairing a car after an accident, fixing a fence that you damaged, or repairing the front of a building.

Deductible

- A deductible is the amount of money you are required to pay out of pocket before your insurance policy begins to cover a claim. This is a key feature of many types of insurance policies, including homeowners, renters, and auto insurance. A policy may have multiple deductibles depending on the coverage it includes.

Collision Coverage

- Collision coverage is a type of auto insurance that can help pay for damage to your vehicle from collisions, regardless of who was at fault in such incidents. It is generally recommended to protect yourself from costly out-of-pocket costs associated with vehicular collisions by purchasing this insurance.

Comprehensive/OTC (other than collision) coverage

- Provides protection for the owner of the vehicle if it is damaged due to vandalism, theft, hail, fallen trees, and other covered perils. This coverage can help pay for the costs associated with repairing or replacing the vehicle.

Medical Payments Coverage

- Covers medical expenses if you or your passengers are injured in an accident.

Uninsured and Underinsured Motorist Coverage

- Protects you financially in the event that the other driver is at fault and does not have insurance. This coverage can help pay for your medical expenses, property damage, and other losses.

Roadside Assistance

- Roadside assistance is a service that covers the cost of common roadside services like tire changes and jump-starts.

Rental Reimbursement

- Provides financial assistance for car rental expenses when your vehicle is in the shop as a result of a collision or other covered loss.

Home Insurance Terms to Know

Dwelling Coverage

- Protects the physical structure of your home, like walls and roof. This type of coverage can help you repair or rebuild your home in the event of a covered loss.

Personal Property Coverage

- Personal property coverage protects the objects inside your home or garage even if they're damaged or stolen outside the house.

Personal Liability Coverage

- Protects you and your family in the event that you are held responsible for an accidental injury or property damage. This can include fees associated with a legal defense, as well as any settlements or judgments levied against you.

Medical Payments Coverage

- Protects the policyholder from any medical expenses incurred as a result of an accident on their property.

Water Backup Coverage

- Water backup coverage provides protection for your property in the event of a clogged sewer line, failed sump pump, or backed-up drains. This type of coverage can also help protect your home from mold damage caused by water or sewer backup.

Service Line Coverage

- Protects the policyholder from unexpected expenses related to the damage of pipes, wiring, or utility lines coming onto their property. This type of coverage can provide financial assistance for the excavation and repair of underground wiring and piping.

Identity Theft Coverage

- Identity theft insurance is designed to reimburse victims for money spent on reclaiming their financial identities and repairing their credit reports.

Scheduled articles i.e jewelry, fine arts, collectibles

- Scheduled coverage is a type of property insurance that provides protection for specific items that are not usually covered under a non-scheduled policy. This type of coverage is often needed for high-value items such as jewelry, fine arts, and collectibles.

Boat Insurance, Motorcycle Insurance, & RV Insurance

Terms to Know

Boat Coverage

- Helps protect you and your boat or personal watercraft if it is stolen, damaged in an accident, or affected by a covered incident like fire or lightning. Boat insurance can also help cover you if you accidentally injure someone or damage someone else's personal property with your vessel.

Motorcycle Coverage

- Motorcycle insurance policies generally provide coverage for both bodily injuries and property damage. This is mandated in most states, but there are a number of optional coverages that riders can choose from as well. These might include comprehensive and collision insurance, which would help to pay for damages to the bike if it's involved in an accident.

RV Coverage

- Provides protection if you cause injuries or damage to others while driving your recreational vehicle. This type of insurance can also cover the cost of damages to your recreational vehicle if a covered incident like vandalism or theft occurs.

Umbrella Insurance Terms to Know

What is an Umbrella Policy?

- Excess liability insurance, commonly known as an umbrella policy, is a type of insurance coverage that provides protection beyond the limits of your other liability policies. An umbrella policy kicks in when you've reached the limit on your home or auto insurance policy. It provides additional coverage against claims for bodily injury and personal injury such as defamation or invasion of privacy. Umbrella policies are inexpensive and are well worth the cost if you have assets to protect.

- Umbrella policies are particularly effective for these scenarios:

- Have a mortgage

- Youthful drivers

- Business owners

- Secondary home

- Own a boat or other personal watercraft

- Own a recreational vehicle such as a motorcycle or ATV

- Own a swimming pool or trampoline

- Dog owners

AWARDS