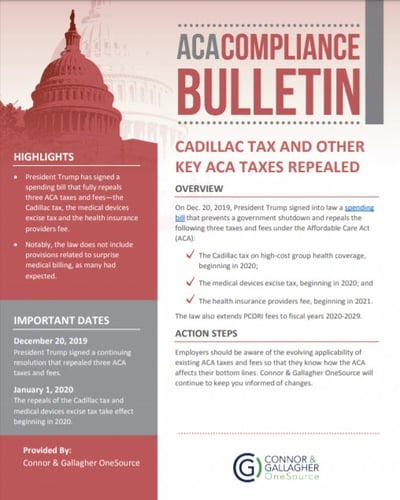

On Dec. 20, 2019, President Trump signed a spending bill into law that includes the repeal of three ACA taxes and fees - the Cadillac tax, the medical devices excise tax and the health insurance providers fee. The health insurance providers fee is still in effect for 2020 but will be permanently eliminated in 2021. The Cadillac tax and medical device excise tax have been permanently eliminated effective for 2020.

How does this impact health insurance costs to your organization?

The repeal of the Cadillac tax won't be felt because it was never actually implemented, and the medical device tax has not been collected since 2016. What will have an impact on your health insurance costs though is the elimination of the health insurer tax and the extension of the PCORI fees.

For organizations with fully-insured health plans - the elimination of the health insurer tax (also called the health insurance providers fee) is good news. While employers were not directly subject to the health insurance providers fee, many providers of fully-insured health plans have been passing the cost of the fee (approximately 2.5%) on to the employers sponsoring the coverage. As a result, this repeal may result in savings for some employers on their fully-insured health insurance rates beginning in 2021. Fully-insured organizations are not impacted by the PCORI fee extension.

For organizations with self-insured health plans - The elimination of the health insurer tax will not impact you, but the extension of PCORI fees will. Under the ACA PCORI fees were to be collected from self-insured organizations from October 1, 2012 to October 1, 2019. This new law however reinstates PCORI fees for the 2020 - 2029 fiscal years. As a result, specified health insurance policies and applicable self-insured plans must continue to pay these fees through 2029. The fee is typically due July 31 each year. For our employee benefits clients: as we have done in the past, CGO will continue to help you calculate and pay the appropriate PCORI fee.

Our full compliance bulletin can be viewed here for additional details.

This blog post is not intended to be exhaustive nor should any discussions or opinions be construed as legal advice - it is intended for educational and/or informational purposes only.