Protecting Your Bottom Line: The Importance of Business Income Insurance

In the world of business, where unforeseen events can disrupt operations and impact revenue streams, safeguarding your company's financial stability is paramount. One often overlooked but crucial aspect of risk management is Business Income Insurance, also known as Business Interruption Insurance. This type of coverage can be a lifesaver when unexpected circumstances threaten your ability to generate revenue.

Understanding Business Income Insurance

Business Income Insurance is designed to protect businesses from financial losses caused by interruptions to normal operations. These interruptions can result from various events such as natural disasters (like hurricanes or earthquakes), fires, equipment breakdowns, or even civil unrest. When such events occur, they can lead to a temporary shutdown or a significant reduction in business activities, directly impacting your cash flow and profitability.

How Does Business Income Insurance Work?

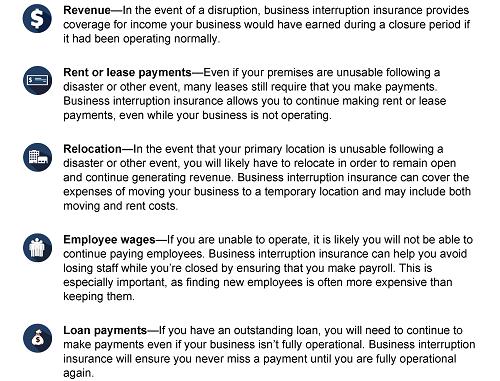

When you have Business Income Insurance, your policy typically covers the income your business would have earned during the period of disruption. This includes ongoing expenses like payroll, rent or mortgage payments, utilities, and other fixed costs that continue even when your business isn't operating at full capacity or is entirely shut down.

The coverage kicks in after a waiting period, which is usually a few days after the incident causing the interruption. It can help bridge the financial gap until your business can resume normal operations, assisting in covering lost profits and enabling you to meet your financial obligations.

Key Benefits of Business Income Insurance

- Maintaining Cash Flow: One of the primary benefits is that it helps ensure a steady cash flow during challenging times. This can be crucial for meeting financial commitments like loan payments, vendor invoices, and employee salaries.

- Continuity of Operations: Business Income Insurance enables you to focus on getting your business back on track without worrying excessively about the immediate financial strain. It provides a safety net to navigate through the recovery period.

- Protecting Investments: For businesses with substantial investments in equipment, inventory, or infrastructure, this insurance safeguards those investments by covering losses incurred due to covered events.

- Reputation Management: A quick recovery and continuity of services can also help protect your business's reputation. Customers and clients appreciate businesses that can weather challenges and continue providing reliable services.

Considerations When Choosing Business Income Insurance Coverage

When considering Business Income Insurance, there are several factors to keep in mind:

- Coverage Limits: Ensure that your policy covers a sufficient amount to meet your financial needs during an interruption period. Underestimating this can leave you exposed to significant financial losses.

- Exclusions and Limitations: Understand the exclusions and limitations of your policy. Some events, such as pandemics, may not be covered unless specifically included or added as an endorsement.

- Waiting Periods: Be aware of the waiting period before coverage begins. Choose a waiting period that aligns with your business's ability to withstand a temporary interruption without financial strain.

- Review Regularly: As your business evolves, periodically review your insurance coverage to ensure it still adequately protects your interests.

Conclusion

Business Income Insurance is a valuable tool for businesses of all sizes and types. It provides financial protection during unforeseen disruptions, allowing you to focus on recovery rather than worrying about immediate financial challenges. By understanding your risks, choosing appropriate coverage, and regularly reviewing your insurance needs, you can safeguard your bottom line and ensure the long-term resilience of your business.

Business income insurance policies are an important component of commercial property and casualty insurance. Business interruption insurance policies can be complex, so it's important to work with your insurance broker when seeking coverage. We're here to help.

Author

Bryan Stratman, Business Insurance Consultant at Connor & Gallagher OneSource (CGO)

Contact us at info@GoCGO.com

Connor & Gallagher OneSource is an insurance broker located in Lisle, Illinois, and was founded in 1997. We have consultants and service teams specializing in each of the areas of business insurance broker, benefits broker, HR and Payroll services, and company retirement plan services.

We also have home and auto insurance services and financial planning services.

.png?width=3000&height=2250&name=Copy%20of%20CGO%20Service%20Divisions%202023%20(1).png)

This blog is for educational and/or informational purposes only and does not constitute tax, financial, or legal advice.