After many rounds of interviews, you finally found the perfect candidate for an important role in your company. The question is, how do you compensate?

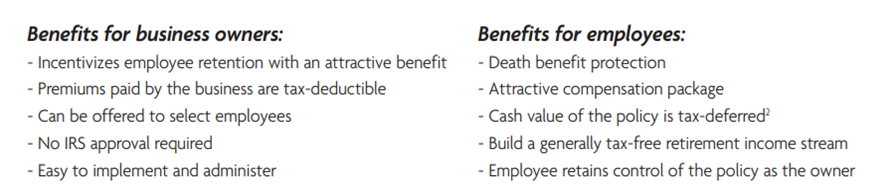

You don’t want to give up ownership or control of the business at this point in time, but you know that attracting, retaining and rewarding key employees can be challenging.

You are also aware that certain key employees have inquired about other types of compensation beyond the traditional 401(k) plan as well. The stakes are high, and you want to get this decision right for this potential candidate, other key employees, and the future of your company.

According to the Harvard Business Review on Employee Incentives, “Compensation Packages That Actually Drive Performance,” they write,

1)Decisions about executive pay can have an indelible impact on a company. When compensation is managed carefully, it aligns people’s behavior with the company’s strategy and generates better performance. When it’s managed poorly, the effects can be devastating: the loss of key talent, demotivation, misaligned objectives, and poor shareholder returns. Given the high stakes, it’s critical for boards and management teams to get compensation right.

One program worth looking at is an executive bonus plan (sometimes called a Section 162 plan).

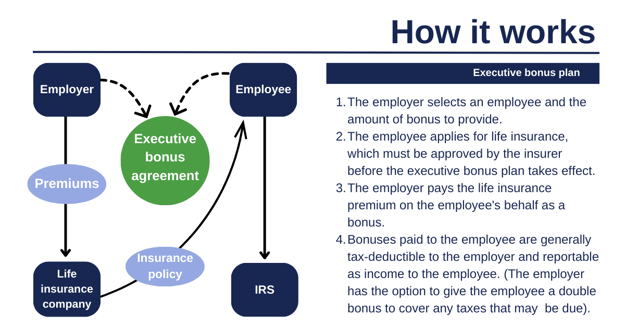

Here’s how this Executive Bonus Plan works.

A Section 162 executive bonus plan is a way to attract, reward, and retain key employees using life insurance.

The employer takes out a life insurance policy on a key employee. The employee is the owner of the policy, and gets to determine the beneficiaries and manage the funds within the policy. The employer covers the cost of the policy by periodically giving the employee a bonus big enough to pay the policy premiums. The employee then pays the premiums to the insurance carrier.

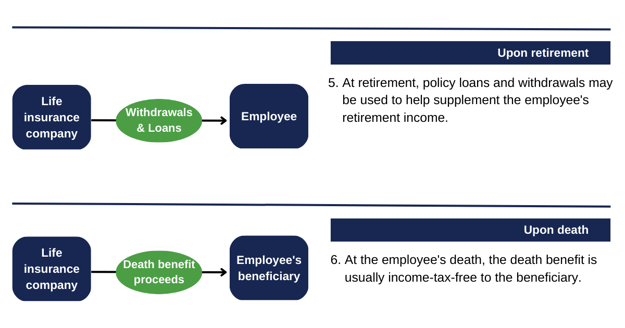

When the employee reaches retirement age — or sooner, depending on how the arrangement is set up — they can access the cash value of the policy for extra income if they want. If the employee dies, the death benefit of the policy would go to their family or other named beneficiaries.1

Setting the Plan Up for Success:

Retirement Achieved:

Results:

An executive bonus plan funded with life insurance is designed to reduce turnover of key employees that could result in potentially significant financial losses.

This strategy can reward key employees with a unique and exclusive benefit that provides protection for their families during their employment, and later, a potential supplement to retirement income. (2)

If you would like to discuss a strategy around an Executive Bonus Plan for your firm, please reach our Wealth Manager, Scott Krase, skrase@cgofinancial.com

Thank you for reading.

This blog is for educational and/or informational purposes only and does not constitute legal advice.

References:

HBR, https://hbr.org/2021/01/compensation-packages-that-actually-drive-performance

1Distributions under the policy (including cash dividends and partial/full surrenders) are not subject to taxation up to the amount paid into the policy (cost basis). If the policy is a Modified Endowment Contract, policy loans and/or distributions are taxable to the extent of gain and are subject to a 10% tax penalty. Access to cash values through borrowing or partial surrenders will reduce the policy's cash value and death benefit, increase the chance the policy will lapse, and may result in a tax liability if the policy terminates before the death of the insured.

2. Policy loans from life insurance policies generally are not subject to income tax, provided the contract is not a Modified Endowment Contract (MEC), as defined by Section 7702A of the Internal Revenue Code. A policy loan or withdrawal from a life insurance policy that is a MEC is taxable upon receipt to the extent cash value of the contract exceeds premium paid. Distributions from MECs are subject to federal income tax to the extent of the gain in the policy and taxable distributions are subject to a 10% additional tax prior to age 59½, with certain exceptions. Policy loans and withdrawals will reduce cash value and death benefit. Policy loans are subject to interest charges. Consult with and rely on your tax advisor or attorney on your specific situation. Income and growth on accumulated cash values is generally taxable only upon withdrawal. Adverse tax consequences may result if withdrawals exceed premiums paid into the policy. Withdrawals or surrenders made during a Surrender Charge period will be subject to withdrawal charges, processing fees, or surrender charges, and may reduce the ultimate death benefit and cash value. Surrender charges vary by product, issue age, sex, underwriting class, and policy year. Income and growth on accumulated cash values is generally taxable only upon withdrawal. Adverse tax consequences may result if withdrawals exceed premiums paid into the policy. Withdrawals or surrenders made during a Surrender Charge period will be subject to withdrawal charges, processing fees, or surrender charges, and may reduce the ultimate death benefit and cash value. Surrender charges vary by product, issue age, sex, underwriting class, and policy year.

3. Pictures provided by Midland Insurance Company