Are you contemplating leaving your Professional Employer Organization (PEO)? If so, you should carefully consider the time of year you make the transition. If you want to leave your PEO mid year it can be done, but there are some tax and benefit implications you should be aware of which this blog will explain.

Considerations for Leaving a PEO Mid Year

- First and foremost, review the parameters of your contract. Most PEO’s renew mid-year, on either June 1 or July 1. PEOs typically require 60 days advance notice of the renewal date of your intention to non-renew.

- There are also tax implications to consider if you decide to transition mid-year. Your employees will be viewed as new hires to your organization when you take them back from the PEO. You need to make sure that you have your federal and state tax ID numbers in place, as you will be responsible for tax payments under your own ID’s for the remainder of the year. The wage base for FUTA and SUTA will also reset at the time of transition.

- Lastly, the PEO will have to complete and pay taxes up through the term date and will issue a W-2 to your employees for that timeframe. You will also issue a W-2 for the remainder of the year that they are being paid under your tax ID’s. Therefore, the employee will have to account for two W-2’s from two employers. The employee can reconcile any excess payroll taxes when they complete their individual tax returns.

When is the Best Time of Year to Leave a PEO?

The best time of year to leave a PEO is January 1. The reasons for that are two-fold. First, the employees will not receive two W-2's. If you leave mid year, they will receive one from the PEO and one from the new payroll provider because wages and taxes are being paid under two separate federal IDs. The business will also have to duplicate some tax payments related to FUTA and SUTA because the wage bases will reset when they start paying taxes again under their own tax ID. The other main reason is surrounding deductibles for benefits. It is very hard to procure information from a PEO once you decide to exit. So, getting a deductible credit report of what employees have met already for the year can be challenging and we don't want the employees' deductible resetting in the middle of a plan year.

Why Leave a PEO?

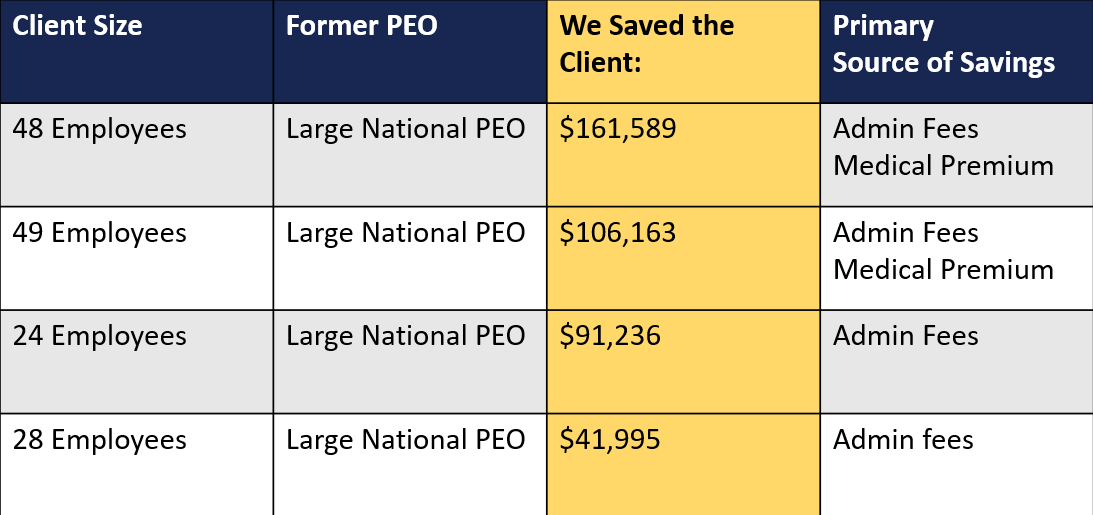

The main reasons we see organizations leave a PEO are cost savings, better service, and a lack of transparency. In many cases, PEO clients have the perception that they are capturing economies of scale on insurance products such as employee benefits and workers' compensation by joining the PEO’s “pool.” This perception is inaccurate. In today’s market, insurance rates from PEOs are usually as high, or higher in many cases, when compared to what a client can procure in the open market. In addition, PEOs are a fully bundled service offering with little flexibility for the client. Clients are ultimately paying for a multitude of included services, which in many cases are not being used. In addition, most PEOs charge a percentage of paid client wages and are reluctant to disclose actual fees. This results in PEO clients constantly guessing as to what their actual costs are.

In a PEO you pay a percentage of wages. That means your PEO makes money off any overtime, vacation, commission, and bonuses you give employees. We take the fat out of the PEO price structure to create significant PEO cost savings with total transparency and excellent customer service.

We offer everything a PEO does but on an à la carte menu. You pick the services you want to be included in your package. This gives you more options and saves you money.

- We administer the employment relationship. We'll do the paperwork, complete forms, maintain records, and keep you in compliance.

- Under our model you pick your group health insurance carrier (including BlueCross BlueShield) and completely define your employee benefits package.

- We focus on the critical elements of the employment relationship - administration and compliance.

- We provide support for the HR and risk management decisions that you make for your business.

What Happens When You Leave a PEO

There's many moving parts when exiting a PEO so it's important to be prepared. We created a blog post on exiting a PEO to help organizations understand what to expect from the perspective of taxes, employee benefits, retirement plan, workers' compensation, and employer practice liability insurance.

In conclusion, we hope you found the information in this blog about leaving a PEO mid year to be helpful. If you are planning to exit a PEO we're here to help with this transition. Our team can be contacted at info@GoCGO.com

The views expressed by the authors on this website do not necessarily reflect the views of the website owners, operators, or any affiliated organizations. This blog is for educational and/or informational purposes only and does not constitute tax, financial, or legal advice.

While we’ve done our best to provide accurate and current information at the time of writing this blog, the information within this article is not guaranteed to be complete, correct, timely, current or up-to-date. Similar to any printed materials, the information may become out-of-date. The Authors undertakes no obligation to update any Information on the Site; provided, however, that the Authors may update the Information at any time without notice in the Authors’ sole and absolute discretion. The Authors reserve the right to make alterations or deletions to the Information at any time without notice.