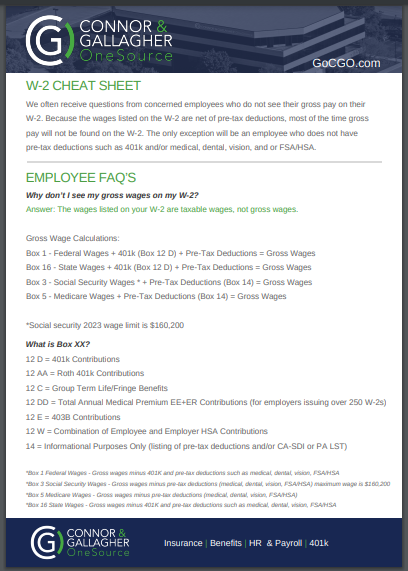

Our payroll services team often receives questions from concerned employees who do not see their gross pay on their W-2. Because the wages listed on the W-2 are net of pre-tax deductions, most of the time gross pay will not be found on the W-2. The only exception will be an employee who does not have pre-tax deductions such as 401k and/or medical, dental, vision, and or FSA/HSA.

Should this type of question come up from your employees, you can use the following FAQs and downloadable "W-2 Cheat Sheet" to share with them. Please note, this blog was written in January 2024 for the 2023 tax year.

EMPLOYEE FAQs

Why don’t I see my gross wages on my W-2?

Answer: The wages listed on your W-2 are taxable wages, not gross wages.

Gross Wage Calculations:

- Box 1 - Federal Wages + 401k (Box 12 D) + Pre-Tax Deductions = Gross Wages

- Box 16 - State Wages + 401k (Box 12 D) + Pre-Tax Deductions = Gross Wages

- Box 3 - Social Security Wages * + Pre-Tax Deductions (Box 14) = Gross Wages

- Box 5 - Medicare Wages + Pre-Tax Deductions (Box 14) = Gross Wages

*Social Security 2023 wage limit is $160,200

What is Box XX?

12 D = 401k Contributions

12 AA = Roth 401k Contributions

12 C = Group Term Life/Fringe Benefits

12 DD = Total Annual Medical Premium EE+ER Contributions (for employers issuing over 250 W-2s)

12 E = 403B Contributions

12 W = Combination of Employee and Employer HSA Contributions

14 = Informational Purposes Only (listing of pre-tax deductions and/or CA-SDI or PA LST)

* Box 1 Federal Wages - Gross wages minus 401K and pre-tax deductions such as medical, dental, vision, FSA/HSA

* Box 3 Social Security Wages - Gross wages minus pre-tax deductions (medical, dental, vision, FSA/HSA) maximum wage is $160,200

* Box 5 Medicare Wages - Gross wages minus pre-tax deductions (medical, dental, vision, FSA/HSA)

* Box 16 State Wages - Gross wages minus 401K and pre-tax deductions such as medical, dental, vision, FSA/HSA

Download our W-2 Cheat Sheet Here (for the 2023 tax year):

This blog is for educational and/or informational purposes only and does not constitute tax, financial, or legal advice.